Household Robots Market Size, Share & Growth Forecast 2026–2035

| Price : US $2800 | Date : Jan 2026 |

| CAT ID : 8 | Pages : 215 |

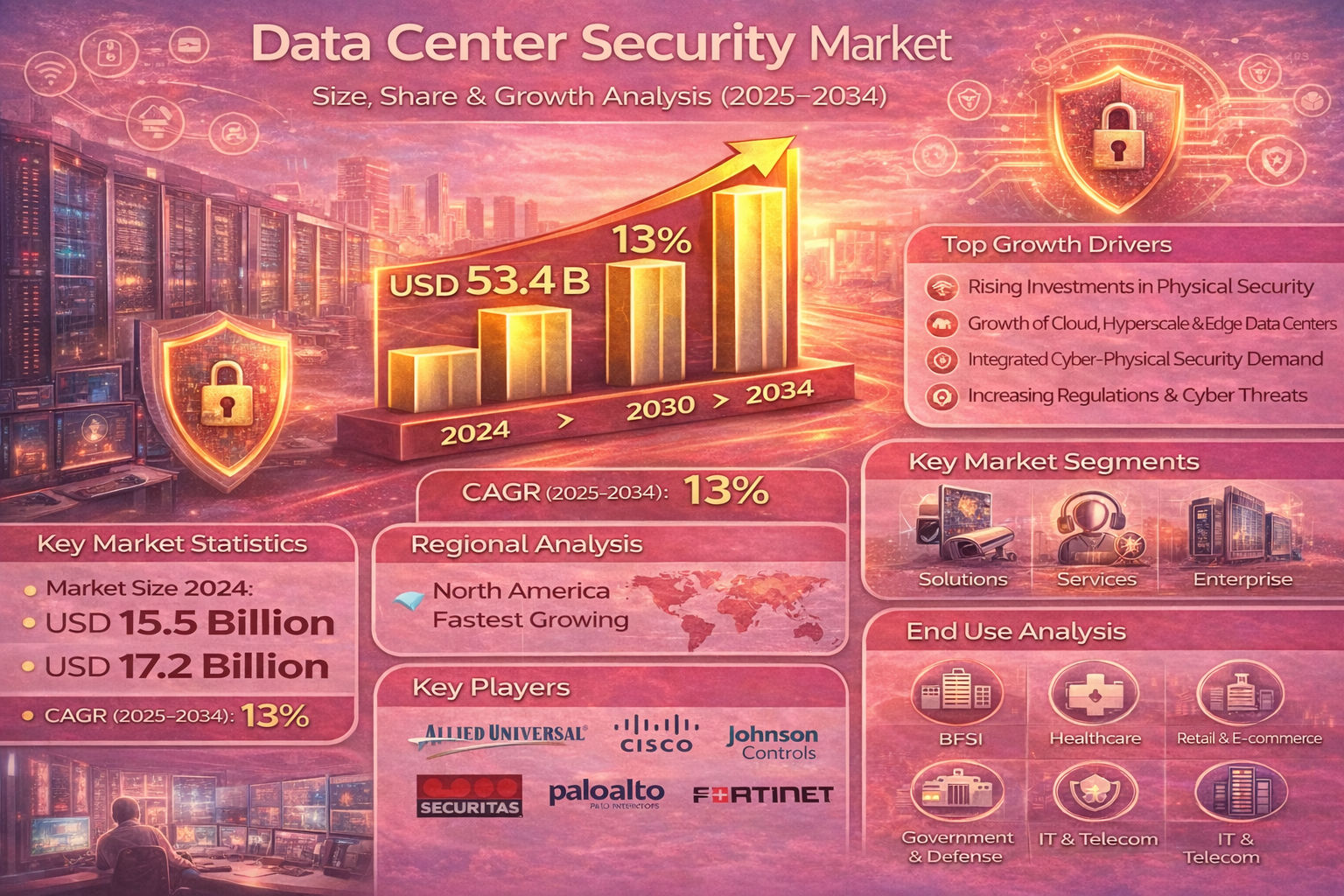

The global Data Center Security Market has emerged as a critical pillar of modern digital infrastructure, driven by the rapid expansion of cloud computing, hyperscale facilities, edge data centers, and rising cyber-physical threats. In 2024, the market was valued at approximately USD 15.5 billion and is projected to grow from around USD 17.2 billion in 2025 to nearly USD 53.4 billion by 2034, expanding at a strong CAGR of about 13% during the forecast period.

Data center security encompasses a comprehensive framework of physical security, network protection, data security, identity management, and threat intelligence. As enterprises increasingly rely on digital infrastructure to store mission-critical and sensitive data, security failures can lead to severe financial losses, regulatory penalties, operational downtime, and reputational damage. As a result, organizations are prioritizing integrated security strategies that combine cyber and physical protection layers.

Modern data centers operate in a complex threat environment where cyberattacks, insider threats, physical breaches, and compliance risks coexist. Traditional siloed security approaches are no longer sufficient. Instead, operators are adopting unified cyber-physical security architectures supported by AI-driven monitoring, real-time analytics, and automated incident response.

The rise of hybrid and multi-cloud environments, combined with increasing regulatory oversight such as GDPR, NIST, ISO, HIPAA, and national data sovereignty laws, has further intensified demand for advanced security frameworks. Enterprises now view security not only as a defensive requirement but also as a strategic enabler for trust, scalability, and business continuity.

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 15.5 |

| 2025 | 17.2 |

| 2030 | 33.8 |

| 2034 | 53.4 |

The data center security landscape is rapidly evolving with the convergence of cybersecurity and physical security technologies. AI-driven threat detection, behavioral analytics, and zero-trust architectures are increasingly being deployed to proactively identify vulnerabilities before they escalate into incidents.

Another major trend is the shift toward managed and outsourced security services, particularly among mid-sized enterprises and colocation providers. These services offer 24/7 monitoring, threat intelligence, compliance management, and incident response without the need for large in-house teams.

Additionally, the growing adoption of edge computing has introduced new security challenges due to remote locations and limited onsite staffing. This has increased reliance on automated surveillance, remote access control, and cloud-based security management platforms.

Security solutions account for over 74% of total market revenue. These include physical security systems such as biometric access control, surveillance cameras, perimeter protection, and intrusion detection, as well as cybersecurity tools including firewalls, endpoint detection and response (EDR), intrusion detection/prevention systems (IDS/IPS), data encryption, and AI-powered threat intelligence.

Security services include consulting, system integration, managed security services, monitoring, compliance support, and maintenance. Managed services are gaining strong traction as organizations seek continuous protection, rapid incident response, and regulatory compliance without expanding internal teams.

Healthcare and BFSI sectors collectively account for a significant share of the market due to strict regulatory requirements, sensitive data handling, and high financial risks associated with breaches.

North America remains the largest market, led by the U.S., supported by high data center density, advanced cybersecurity adoption, and strict regulatory frameworks.

Europe shows steady growth driven by GDPR enforcement, data sovereignty initiatives, and expanding digital infrastructure across Germany, the UK, and France.

Asia-Pacific is the fastest-growing region, fueled by rapid cloud adoption, hyperscale expansion, and government-led digital transformation initiatives in China, India, and Southeast Asia.

Rising investments in smart cities, AI data centers, and national digital infrastructure projects are driving market growth in UAE, Saudi Arabia, and Brazil.

The data center security market is moderately consolidated, with leading players focusing on AI-driven security platforms, integrated cyber-physical solutions, and strategic acquisitions.

The data center security market is expected to witness sustained growth over the next decade, supported by rising digital dependency, stricter regulations, and increasing sophistication of cyber threats. The convergence of AI, automation, and predictive analytics will redefine how security risks are detected and mitigated, making security an integral part of data center design and operations.

Organizations that invest in scalable, compliant, and integrated security frameworks will be better positioned to protect critical assets, maintain trust, and support long-term digital transformation.

| Price : US $2800 | Date : Jan 2026 |

| CAT ID : 8 | Pages : 215 |

| Price : US $3200 | Date : Jan 2026 |

| CAT ID : 8 | Pages : 210 |

| Price : US $2800 | Date : Dec 2025 |

| CAT ID : 8 | Pages : 210 |

| Price : US $3200 | Date : Jan 2026 |

| CAT ID : 8 | Pages : 198 |

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

Customize This Report