Global Piezoelectric Micro Pump Market Analysis by Machine Type, Design, End-Use Industry, and Distribution Channel, 2026–2035

| Price : US $2800 | Date : Dec 2025 |

| CAT ID : 9 | Pages : 210 |

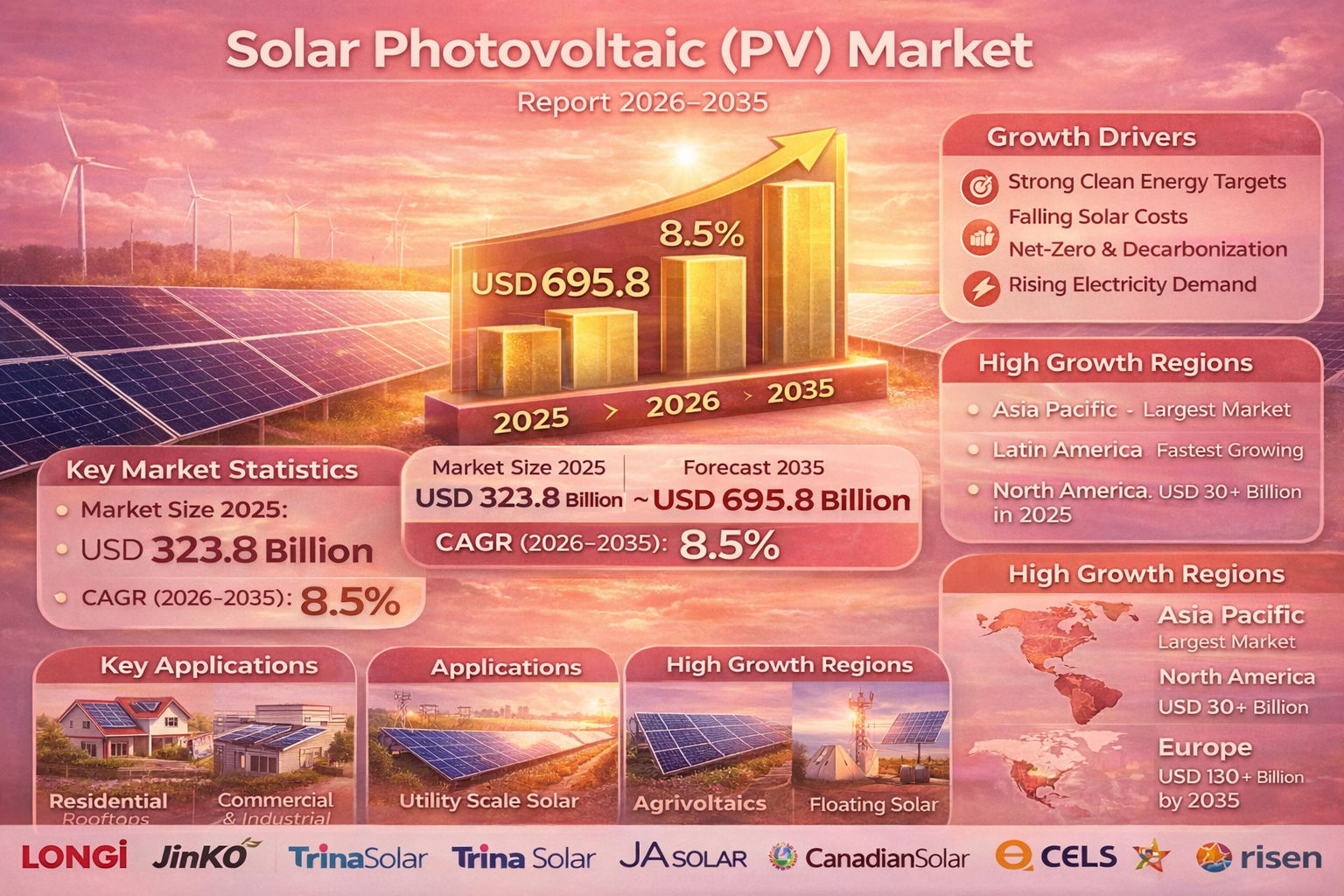

The global solar photovoltaic (PV) market was valued at around USD 323.8 billion in 2025 and is projected to reach nearly USD 695.8 billion by 2035, growing at a steady CAGR of about 8.5% during the forecast period. Growth is driven by strong government support for clean energy, falling solar installation costs, rising electricity demand, and global net-zero commitments.

Solar PV converts sunlight directly into electricity using semiconductor-based panels. Compared to fossil fuels, solar power offers clean, low-cost, and scalable electricity generation. From rooftops to massive solar parks and even floating and agrivoltaic systems, solar PV is becoming the backbone of the global energy transition.

New technologies such as bifacial panels, TOPCon and heterojunction cells, and thin-film modules are increasing efficiency and reducing degradation. In 2024, new high-power modules crossed 700W in utility-scale projects. Floating solar and agrivoltaics are expanding in land-scarce regions. AI-based monitoring systems are optimizing energy output, fault detection, and maintenance scheduling.

Asia Pacific dominates the global market, driven by China, India, Japan, South Korea, and Australia. Strong government programs, falling costs, and massive electricity demand support growth. India is rapidly expanding under national solar missions, while China leads global manufacturing and installations.

The U.S. market crossed USD 30 billion in 2025. Growth is driven by solar-plus-storage projects, corporate renewable procurement, and supportive policies like tax credits and domestic manufacturing incentives.

Europe is expected to exceed USD 130 billion by 2035, supported by climate policies, green energy targets, and strong corporate demand for renewable electricity.

Strong solar radiation and competitive auctions in Saudi Arabia, UAE, and Egypt are creating some of the world’s lowest solar tariffs. Africa is growing through electrification and grid expansion programs.

Brazil, Chile, Mexico, and Colombia lead installations through auctions and long-term PPAs, driven by mining, industrial, and utility demand.

The solar PV market is highly competitive and partially consolidated. The top five companies account for nearly 65% of global shipments. Key strategies include capacity expansion, vertical integration, next-generation cell technology, and regional manufacturing.

LONGi: Global leader with strong n-type and TOPCon technology and large manufacturing scale.

First Solar: Thin-film leader, strong in U.S. and domestic manufacturing programs.

Trina Solar: Known for ultra-high-power modules and global presence.

Vikram Solar: Strong Indian manufacturer aligned with government manufacturing incentives.

The solar PV market will remain one of the fastest-growing energy technologies globally. Falling costs, strong policies, energy storage integration, and smart grid technologies will make solar the core of both centralized and distributed power systems. By 2035, solar PV will be a dominant source of new electricity generation worldwide.

| Price : US $2800 | Date : Dec 2025 |

| CAT ID : 9 | Pages : 210 |

| Price : US $2800 | Date : Dec 2025 |

| CAT ID : 9 | Pages : 189 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 9 | Pages : 160 |

| Price : US $2800 | Date : Jan 2026 |

| CAT ID : 9 | Pages : 210 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 9 | Pages : 204 |

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

Customize This Report