Global Data Center Infrastructure Market – Industry Trends, Market Size, Competitive Landscape & Forecast, 2025–2034

| Price : US $2800 | Date : Dec 2025 |

| CAT ID : 13 | Pages : 198 |

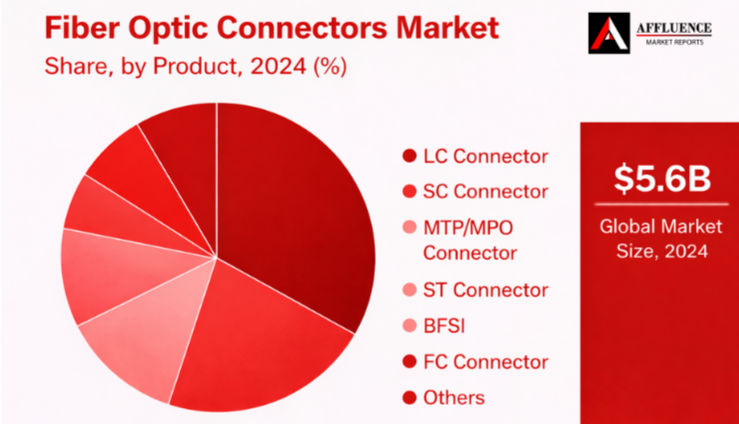

The global Fiber Optic Connectors Market was valued at USD 5.56 billion in 2024 and is projected to reach USD 9.93 billion by 2033, expanding at a CAGR of 6.6% during the forecast period from 2025 to 2033. The market growth is driven by the rapid expansion of cloud computing, artificial intelligence (AI), telecommunications infrastructure, and increasing deployment of IoT-based solutions.

Fiber optic connectors are essential components used to connect optical fibers in telecommunications, data centers, industrial automation, defense, and railway communication systems. The transition from copper-based networks to fiber-optic infrastructure has significantly accelerated demand for high-performance, low-loss connectors capable of supporting high-speed data transmission.

The proliferation of hyperscale data centers, 5G deployment, smart cities, and cloud services is further strengthening the adoption of advanced connector solutions such as LC, MTP/MPO, and FC connectors.

The LC connector segment dominated the market with a revenue share of 35.43% in 2024, owing to its compact design and suitability for high-density data center environments.

The telecom segment accounted for the largest share in 2024 due to the increasing deployment of fiber optic networks to support high-speed internet, 5G, and broadband services.

North America dominated the Fiber Optic Connectors Market with a revenue share of 30.8% in 2024, supported by strong investments in data centers, cloud infrastructure, and 5G networks.

Europe is experiencing steady growth driven by government initiatives supporting digital connectivity, smart city development, and industrial automation.

Asia Pacific is the fastest-growing region, fueled by rapid urbanization, expanding telecom infrastructure, and increasing adoption of cloud and IoT technologies in countries such as China, India, Japan, and South Korea.

| Price : US $2800 | Date : Dec 2025 |

| CAT ID : 13 | Pages : 198 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 13 | Pages : 185 |

| Price : US $3200 | Date : Jan 2026 |

| CAT ID : 13 | Pages : 198 |

| Price : US $1800 | Date : Nov 2025 |

| CAT ID : 13 | Pages : 185 |

| Price : US $1800 | Date : Jan 2026 |

| CAT ID : 13 | Pages : 220 |

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

Customize This Report