800V Electric Vehicle Architecture Market Report 2025–2034: Size, Share, Trends & Growth Forecast

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 220 |

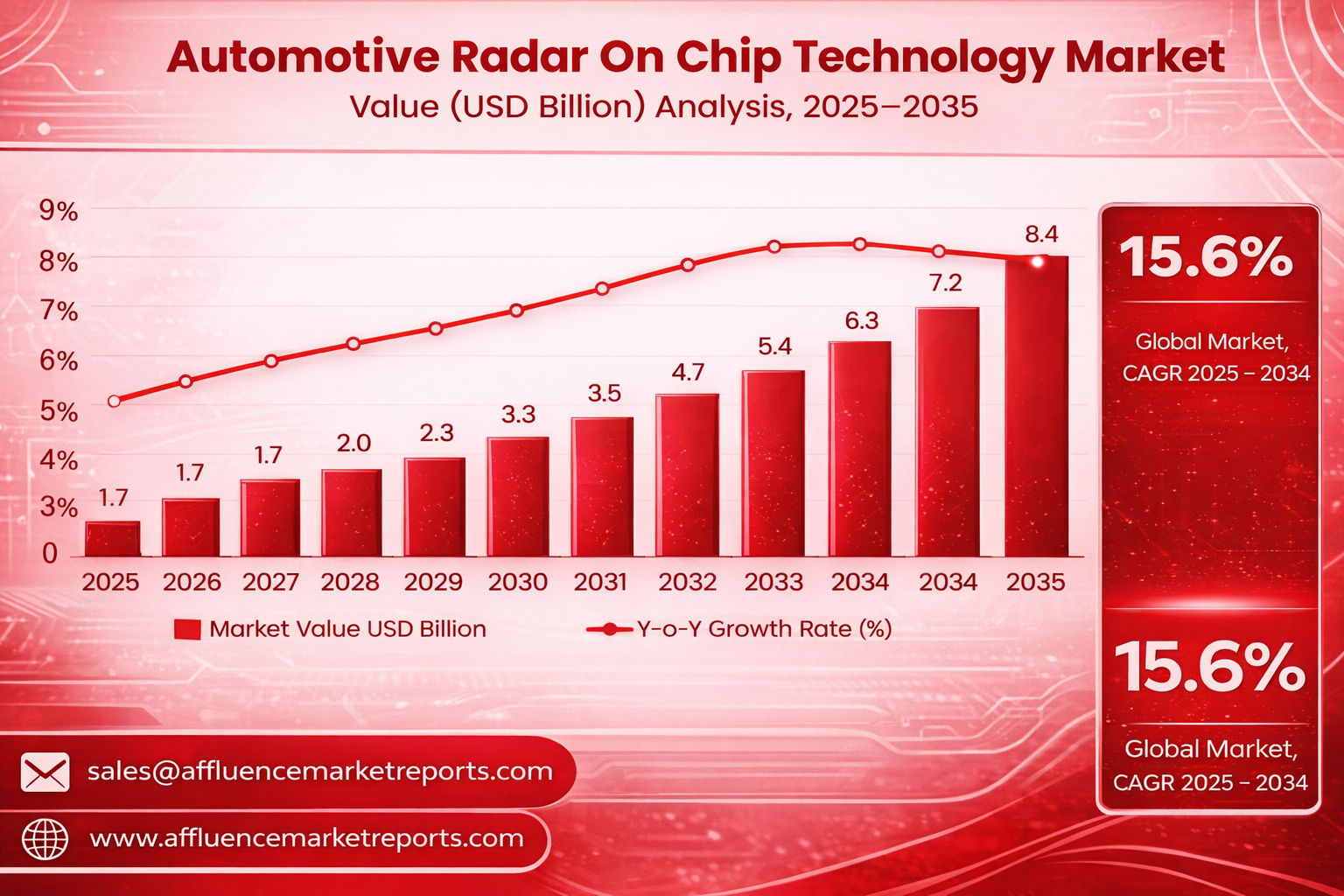

The global automotive radar-on-chip (RoC) technology market was valued at approximately USD 1.7 billion in 2024 and is expected to grow at a robust pace, reaching nearly USD 6.8 billion by 2034. The market is anticipated to expand at a strong CAGR of around 15.6% during the forecast period. This report is published by Affluence Market Reports.

Automotive radar-on-chip technology integrates radar transceivers, antennas, and signal processing components into a single semiconductor chip, enabling compact, energy-efficient, and high-performance radar sensing solutions. These systems are increasingly adopted in modern vehicles to support advanced driver assistance systems (ADAS) and autonomous driving functions.

The growing penetration of electric vehicles, rising safety regulations, and increasing demand for scalable sensor architectures are accelerating the adoption of radar-on-chip platforms across passenger and commercial vehicles.

A key trend shaping the market is the integration of 4D imaging radar capabilities directly into radar-on-chip solutions. These systems provide enhanced object detection, improved angular resolution, and superior performance in adverse weather conditions.

Additionally, AI-powered edge processing and sensor fusion are transforming radar platforms into software-upgradable perception systems, extending product lifecycle and improving adaptability for autonomous driving applications.

The 77 GHz segment dominates the market due to its superior resolution and widespread adoption in long-range radar applications such as adaptive cruise control and collision avoidance.

Single-chip SoC solutions lead the market due to reduced power consumption, lower bill of materials, and simplified system integration.

Asia Pacific holds the largest market share, supported by high vehicle production volumes, rapid ADAS adoption, and strong government initiatives promoting intelligent mobility solutions.

North America exhibits strong growth driven by safety regulations, technological innovation, and increasing deployment of radar-based perception systems in electric and autonomous vehicles.

Europe continues to benefit from strict vehicle safety regulations, strong presence of automotive OEMs, and increasing investments in autonomous driving research and development.

The automotive radar-on-chip technology market is expected to witness significant innovation driven by AI-based perception, 4D radar imaging, and increased integration with vehicle domain controllers. Continued regulatory support and demand for enhanced vehicle safety will further strengthen long-term market growth.

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 220 |

| Price : US $2800 | Date : Sep 2025 |

| CAT ID : 5 | Pages : 180 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 204 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 275 |

| Price : US $3200 | Date : Jan 2026 |

| CAT ID : 5 | Pages : 221 |

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

Customize This Report